The agri-food industry: Separating the wheat from the chaff?

Sector review of the 2023 CIA campaign

Introduction

"The global food consumption alone could add nearly 1 °C to warming by 2100" C.C Ivanovich, T Sun, D.R Gordon, 2023

Food is one of the major challenges of our century in a number of respects: the ability to feed a rapidly growing world population, the consequences for health (diseases encouraged by overeating or junk food in industrialised societies), and lastly for the climate and biodiversity. The way we eat depends directly on the climate, but also has a significant impact on it.

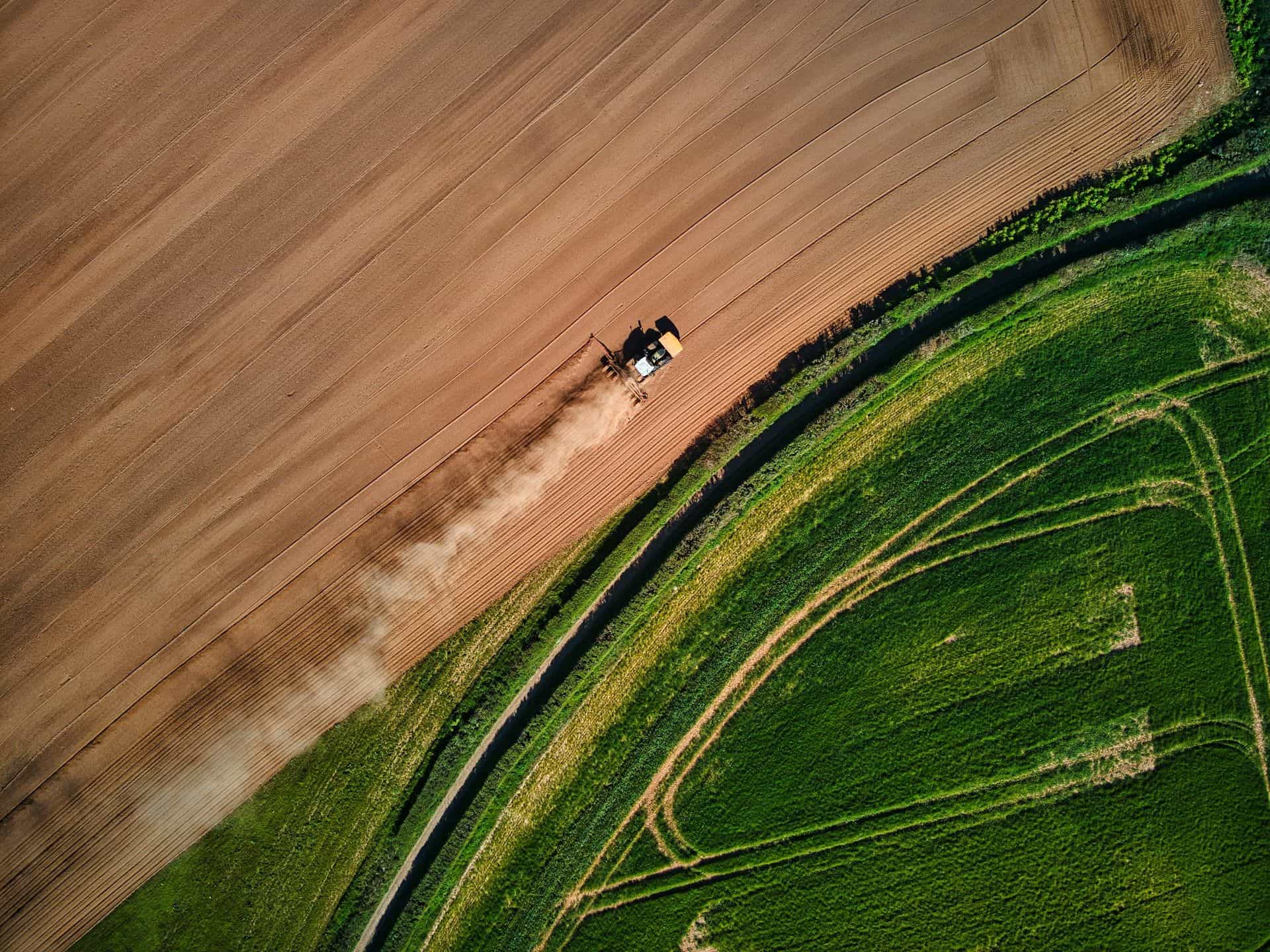

The agri-food industry is the link between the field and our plate. There are many stages in the production of foodstuffs before they reach the end consumer: growing or rearing, processing, packaging and transport. In this long and complex value chain, most greenhouse gas emissions are concentrated in the upstream phase: farming or growing. These emissions are highly dependent on the techniques used and the agricultural products concerned.

Deforestation is one of the main sources of GHG emissions in the sector, but it does not just contribute to climate change. It is also a threat to ecosystems. Biodiversity-related impacts and dependencies are not covered in this publication, but are the subject of our Biodiversity Impact Analytics powered by the Global Biodiversity Score (BIA-GBS) methodology and database.

Summary

The agri-food industry became highly industrialised over the last century, with the advent of petrochemicals, nitrogen fertilisers and ultra-processed foods[1] . These various transformations have led to huge increases in yield and productivity, at the cost of a sharp rise in the sector's greenhouse gas (GHG) emissions.

The agri-food value chain comprises 4 major stages: agricultural production, trading, the transformation of agricultural products into food products and their packaging, and finally the distribution of these products via the various points of sale (e.g. supermarkets).

The agri-food industry is responsible for around a quarter of global GHG emissions[2] and is the biggest emitter of gases other than CO2 such as methane (CH4 ) and nitrous oxide (N2O), gases with a much greater global warming potential than CO2 (30 and 273 times greater respectively)[3] .

In this sector, deforestation is one of the main sources of CO2 emissions. On a global scale, the WRI (World Research Institute) estimates that 50% of agricultural deforestation is directly linked to three consumer products: beef, soya and palm oil[4] . It is regrettable that most of the companies analysed have no strategy for excluding these products and replacing them with others that have a lower impact on the climate.

The main issue for players in the sector is the type of product. Plant-based products generally contain less carbon than animal-based products.

The development of farming techniques that limit soil degradation, as well as extensive livestock farming, is a major lever for the coming decades. Transforming the agro-industry to meet the challenges of climate change requires investment in research and an upgrading of the entire sector, as well as an adaptation of the global food regime.

In the course of this study, 152 companies in the agri-food industry were analysed using the Carbon Impact Analytics (CIA) methodology. These companies represent more than three-quarters of the sector's total market capitalisation. These analyses make it possible to assess the performance of the various players in terms of transition and to evaluate the alignment of their transition strategies with different climate scenarios.

Among these companies, 36% have a good or very good understanding of the issues involved in the climate transition (reflected by a rating of their strategy of 1 to 2), while 64% have a rating of between 3 and 5, reflecting an insufficient or even poor understanding of the issues involved in the climate crisis. Among the latter, only 27% of companies receive a score of 4 or 5/5, corresponding to a poor or very poor understanding of the issues. This percentage of 27% is relatively low and reflects a better understanding of climate issues than in other sectors[5] .

In our sample, only 9 companies produce plant-based alternatives to dairy products and animal proteins. These products are part of the solutions needed to bring the global diet into line with the ecological transition. The business models of these companies are very varied, ranging from meat producers to producers specialising in plant-based alternatives, via diversified food companies. In this context, alignment with the low-carbon transition can still vary greatly between these companies.

Too few players have already established a coherent and comprehensive climate transition strategy, as shown by the low number of companies achieving the highest strategic score, which rewards players who think across their entire value chain, and in particular those who add value to agricultural products derived from low-carbon practices such as agroforestry and/or regenerative agriculture[6] .